Mandatory Electronic Filing of Profits Tax Return (1)

Nov 20, 2025

The Inland Revenue Department (IRD) has committed to taking forward the full adoption of electronic filing (e-filing) of profits tax returns (PTRs) by phases. Under the first phase, Part 4AA entities of in-scope multinational enterprise (MNE) groups are mandated to e-file their PTRs for the year of assessment 2025/26 onwards.

The “once-in, always-in” mechanism applies. If an entity is mandated to e-file its PTR for a year of assessment, it will be mandated to e-file its PTRs for every subsequent year of assessment, regardless of whether it leaves the in-scope MNE group or the MNE group subsequently become out of scope.

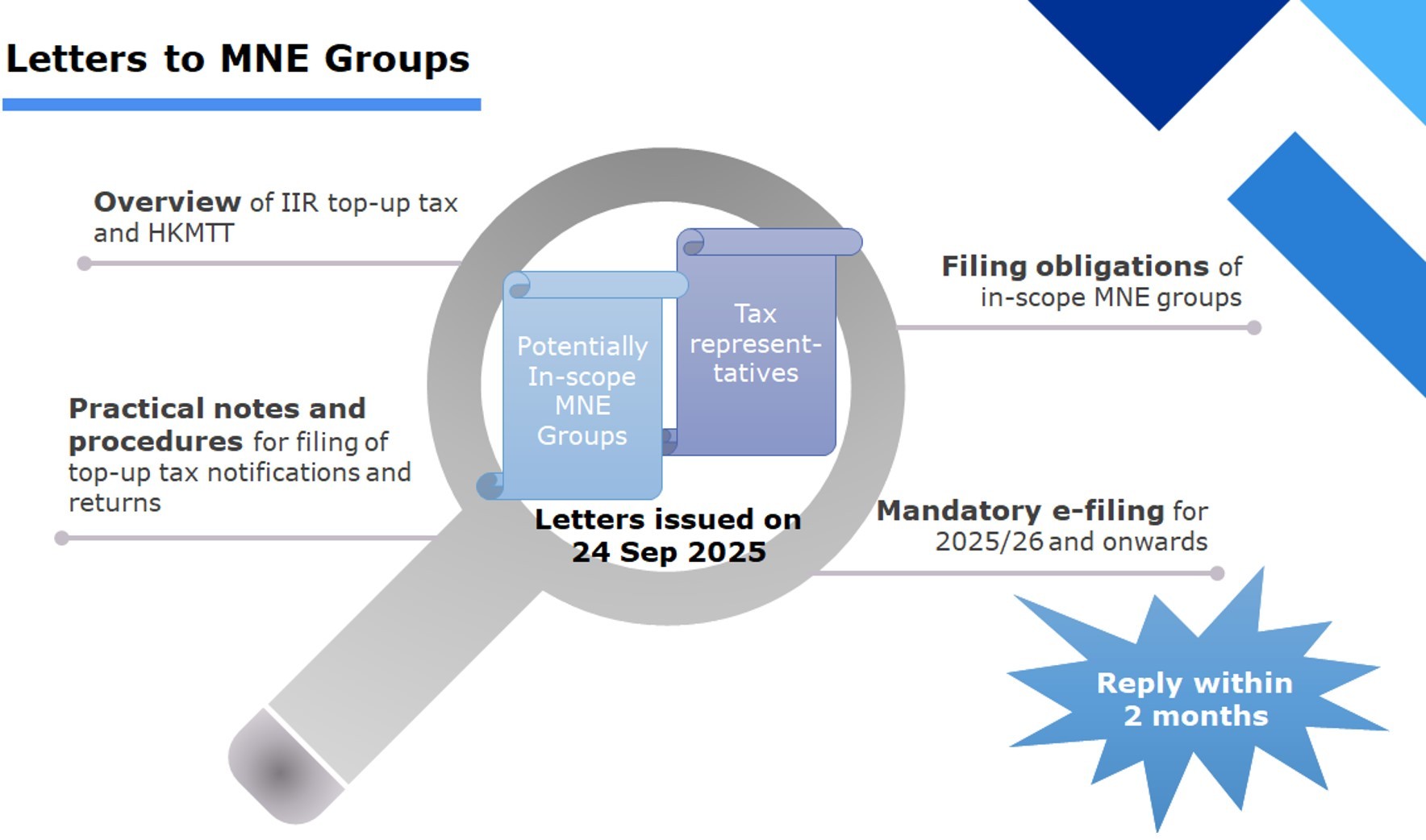

The IRD has issued letters to potentially in-scope MNE groups requesting those in-scope ones to provide a list of Hong Kong entities of the group that will be subject to mandatory e-filing for the year of assessment 2025/26. The reply deadline of 24 November 2025 is approaching.

Find the illustrative examples for in-scope MNE entities: ILLUSTRATIVE EXAMPLES

https://www.ird.gov.hk/eng/tax/beps_efiling_example.htm